Bank Guarantee

Bank garansi terjadi jika bank selaku penanggung diwajibkan untuk menanggung pelaksanaan pekerjaan tertentu, atau menanggung dipenuhinya pembayaran. It allows one to defer payment for goods or services procured on the basis of the security provided by the bank.

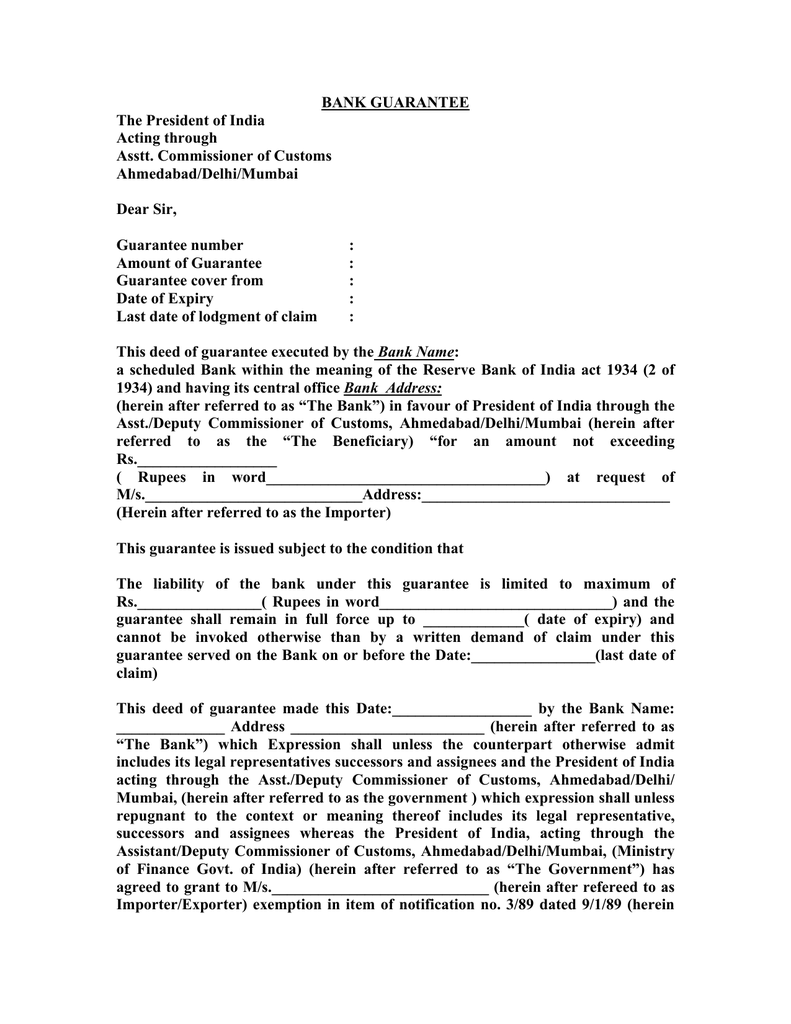

mneconsultantservice Bank Guarantee (20K)

mneconsultantservice Bank Guarantee (20K)

This concept is known as bank guarantee (bg).

Bank guarantee. Anda dapat memilih aneka jenis bank garansi yang sesuai dengan kebutuhan usaha anda. Bank guarantee is a form of promise by the bank on behalf of the buyer and in favour of the seller who provides services on goods or credit. Kemudian, mengenai bank garansi atau jaminan bank, sri soedewi (ibid, hal.

Fixed deposit is a form of term deposit where a fixed. Note that a bank guarantee is not the same as a letter of credit (see the differences between those two below). A bank guarantee is a method through which parties can enter into a contract to ensure smooth transfer of money from the buyer to the seller.

A bank guarantee is an assurance to a beneficiary that the bank will uphold a contract if the applicant and counterparty to the contract are unable to do so. Here, the payment is not sent directly to the seller. This information is current as at 30 july 2020 and is for general information purposes only.

It promotes confidence in a transaction that will greatly encourage the process. A guarantee is a written undertaking by the financial institution that in the event the customer does not meet a certain obligation the financial. Here the bank is known as surety, the buyer as an applicant, and the seller as beneficiary.

A bank guarantee is a promise from a bank or other lending institution that if a particular borrower defaults on a loan, the bank will cover the loss. In such circumstances, approach your bank and ask it to stand as a guarantor on your behalf. Bank guarantee is a guarantee in the form of scripts issued by the bank that may incur the bank's obligation to pay to the beneficiary bank guarantee if the party is guaranteed default.

If x bank requires bank guarantee only, client a can provide a bank guarantee to client b only when client a is a customer of client b where a will give an order to b along with bank guarantee for honoring payment. The bank will pay on behalf of the customer who requests for a bank guarantee. A business benefits from a bank guarantee as:

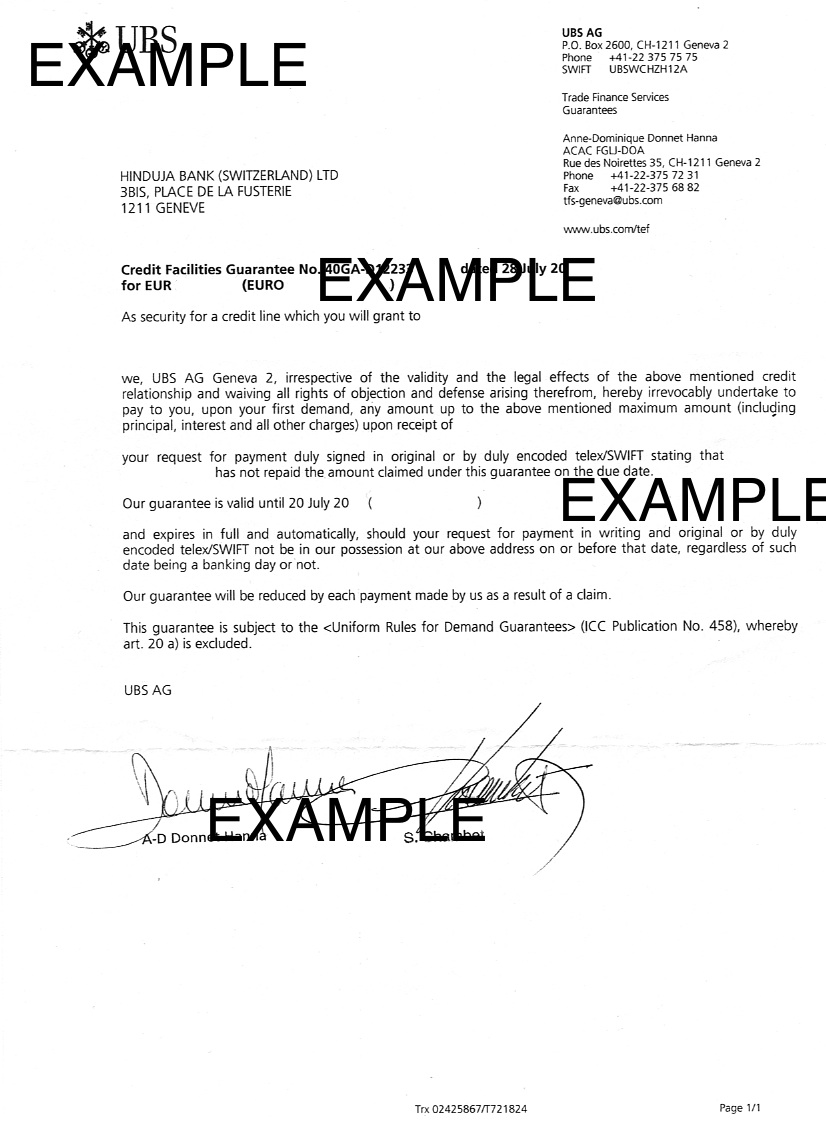

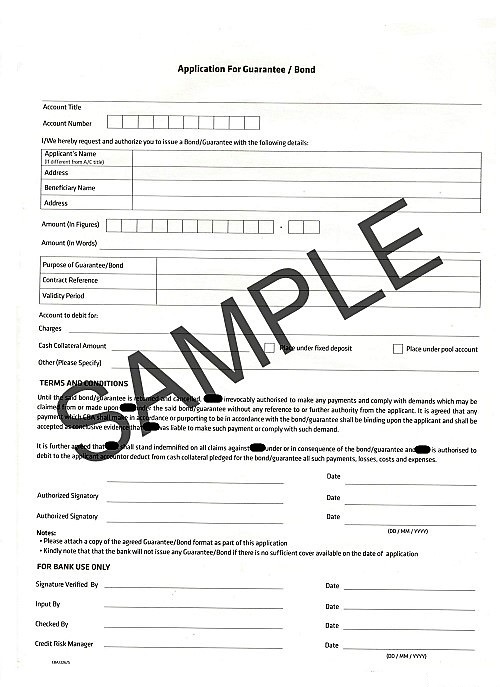

Applicant hereby authorize and consent bank to debit applicant’s account(s) (including withdraw deposit and impose claim on counter guarantee) in bank in accordance to all amount of liabilities towards bank in regards to claim over bank guarantee, or at In fact, the buyer has to invest in a letter of credit from a bank. They are generally importers, exporters or contractors whose business partners demand a promise of payment in some form.

A performance bank guarantee provides a secure promise of compensation of a set amount in the event that a seller does not meet delivery terms or other provisions in the contract. The term “bank guarantee” as the name suggests is the guarantee or assurance given by the financial institution to an external party that in case the borrower is not able to repay the debt or meet its financial liability, then in such an event bank will repay such amount to the party to whom the guarantee is issued. This is usually seen when a small company is dealing with much larger entity or even a government across border.let us take an example of a company xyz bags a project from, say, the government of ethiopia to build 200 power transmission towers.

Bank guarantee is an agreement between 3 parties viz. In general, a bank guarantee is an irrevocable duty the. Bank guarantee are an important banking arrangement and play a vital role in promoting international and domestic trade.

Persyaratan mengenai uang jaminan yang harus dibekukan, tidak merupakan hal yang mutlak, akan tetapi disesuaikan dengan kemungkinan terjadinya resiko. A bank guarantee is a promise from a lending institution that ensures the bank will step up if a debtor can't cover a debt. This guarantee, if provided by the client a, it will be called corporate guarantee in favor of b from a and not bank guarantee.

Counter guarantee untuk bank garansi dalam valuta asing, khusus untuk konsultan yang bonafide, diatur sebagai berikut : Bank guarantee (bg) a bank guarantee is a function that many businesses seek. And the applicant is the party who seeks the bank guarantee from the bank.

Transaksi perdagangan atau proyek dalam nilai yang besar umumnya mempersyaratkan penyertaan jaminan bank (bank guarantee). The bank guarantee is sent to the creditor’s bank or the creditor, or the applicant may be asked to collect it in person to give it to their creditor. The beneficiary is the one to who takes the guarantee.

106) menjelaskan bahwa jaminan bank adalah suatu jenis penanggungan, di mana yang bertindak sebagai penanggung adalah bank. Thereafter, it sends the same to the seller. A bank guarantee is a type of financial backstop offered by a lending institution.

The bank guarantee serves as a risk management tool for the beneficiary, as the bank assumes liability for completion of the contract should the buyer default on their debt or obligation. In action, the bank guarantee is relatively simple. Bank garansi merupakan jaminan yang diterbitkan cimb niaga di mana bank mengikatkan diri untuk membayar sejumlah nilai jaminan yang tercantum dalam bg, apabila nasabah (pemohon) melakukan wanprestasi atau tidak memenuhi kewajiban berdasarkan kontrak atau perjanjian dengan penerima jaminan.

The purpose of this sort of guarantee is to solidify the contractual connection between a seller and buyer. 1 you can choose to accept the bank guarantee via your small business specialist, relationship manager or in your local branch. A bank guarantee is an assurance that a bank provides to a contract between two external parties, a buyer and a seller, or in relation to the guarantee, an applicant and a beneficiary.

A bank guarantee refers to a commercial or financial instrument that is provided by a bank, where the bank assures or guarantees a beneficiary that it will make the payment to the bank in case the actual customer fails to meet his or her obligations. A bank guarantee is a way for companies to prove their creditworthiness. The bank guarantee means that the lender will ensure that the liabilities of a debtor will be met.

Untuk memenuhi kebutuhan bisnis anda ini, manfaatkan layanan bank garansi/standby lc dari kami. Bank guarantees serve the purpose of facilitating business in situations that would otherwise be too risky for the beneficiary to engage. The bank, the beneficiary, and the applicant.

Alternatively, you can elect to have the bank guarantee emailed directly to your customer or supplier. Letters of credit are also financial promises on behalf of one party in. The banks assure the seller, that bank will pay the due amount if the applicant makes to fail payment.

Performance Bank Guarantee Best Performance Bonds YouTube

Performance Bank Guarantee Best Performance Bonds YouTube

Download Sample of Bank Guarantee for Free FormTemplate

Download Sample of Bank Guarantee for Free FormTemplate

Bank Guarantee Justice, Mercy and Grace

Presentationfake bank guarantee

Presentationfake bank guarantee

(PDF) Legal Status of Credit Bank Guarantee in Indonesia’s

(PDF) Legal Status of Credit Bank Guarantee in Indonesia’s

Bank guarantees in international trade by Mohammad

Bank guarantees in international trade by Mohammad

Bank guarantees and guarantees Banking operations

Bank guarantees and guarantees Banking operations

request letter issue bank guarantee, Best Website To Buy

request letter issue bank guarantee, Best Website To Buy

Deposit Guarantee Fund Piraeus Bank in Ukraine

Deposit Guarantee Fund Piraeus Bank in Ukraine

Exposing scam artist Syed Jamaluddin, 'Argo Wealth

Exposing scam artist Syed Jamaluddin, 'Argo Wealth

JUSTFEES easy to pay, easy to collect

What is a bank guarantee? Trade Finance Global

What is a bank guarantee? Trade Finance Global

application for bank guarantee

application for bank guarantee

ขั้นตอนการยื่นวีซ่า Work and Holiday ออสเตรเลีย 2015

Law Web Whether court can grant injunction against

Law Web Whether court can grant injunction against

Comments

Post a Comment